Application Process for Emergency Loans

The software process for emergency loans is often easy and may often be completed on-line. Most lenders require you to fill out an utility kind that includes private information, income particulars, and the amount you wish to borrow. This initial step usually takes only some minu

Understanding Freelancer Loans

Freelancer loans are specifically designed to meet the unique financial challenges that independent workers face. Unlike conventional loans, which can require a steady earnings from a single employer, these loans supply extra flexibility when it comes to compensation and eligibility criteria. Freelancers often face fluctuating incomes, making it essential to pick a loan product that understands their unique circumstan

The average interest rate for emergency loans can vary considerably based mostly on the lender and the borrower's creditworthiness. Generally, charges can range from 5% to 36%, with payday loans typically being on the upper finish. It's essential to match lenders to find the most competitive charges obtaina

What are Day Laborer Loans?

Day Laborer Loans are short-term financing options tailored for individuals who earn revenue on a day-to-day basis. These loans are supposed to bridge monetary gaps that always come up as a outcome of unpredictable nature of day labor work. Laborers might find themselves in situations where their earnings fluctuates significantly from week to week, necessitating a monetary cush

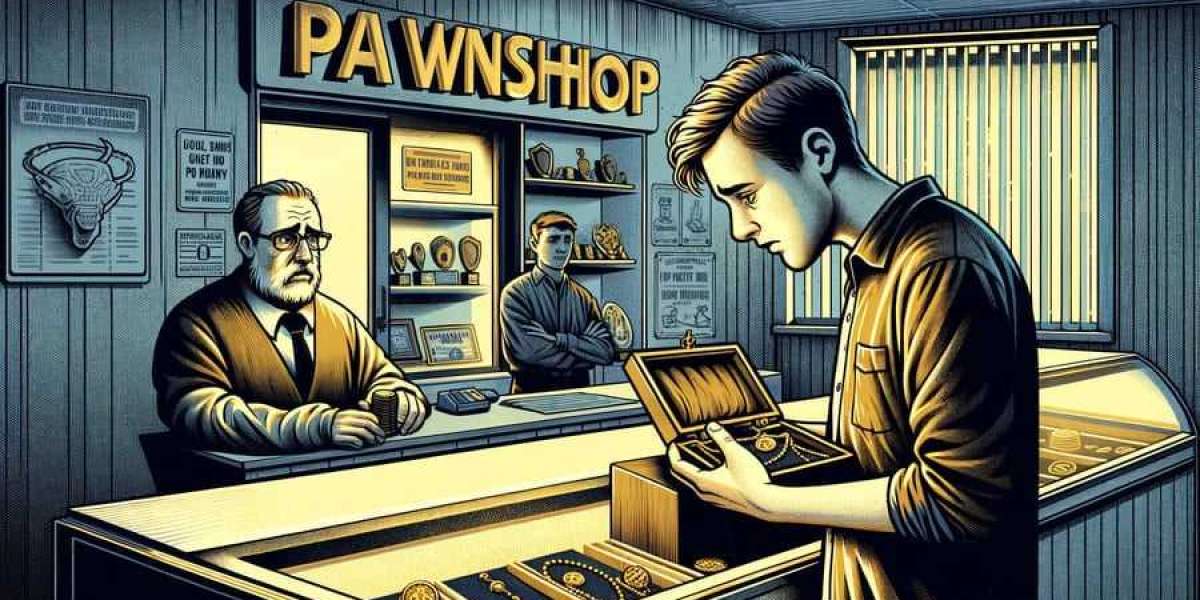

Pawnshop loans supply a unique resolution for people needing quick cash. These loans may be an effective choice for many who might not qualify for traditional financial institution loans due to poor credit score scores or other monetary issues. By using useful objects as collateral, debtors can secure loans with out the stringent necessities of standard financing. This article will discover the fundamentals of pawnshop loans, including how they operate, the pros and cons, and what to consider when in search of out these types of loans. Additionally, we'll introduce Be픽, a comprehensive useful resource for these looking for detailed info and reviews on pawnshop lo

Ensure you make clear how lengthy you have to repay the loan and what occurs if you cannot do so on time. Also, ask about any further fees that may apply, similar to late cost fees or storage fees, which may have an result on the general cost of borrowing. A transparent dialogue with the pawnbroker might help avoid complications afterw

Conclusion on Managing Day Laborer Loans

In conclusion, Day Laborer Loans represent a vital useful resource for people working in temporary or day-to-day positions. By understanding the benefits and disadvantages of these loans, together with the significance of thorough research and responsible borrowing, laborers can effectively handle their funds. Platforms like 베픽 are instrumental in offering critical info and support, guaranteeing that day laborers navigate their financial choices correctly and secur

In today's fast-paced monetary world, securing a mortgage with out an in-person visit has turn out to be a outstanding possibility for lots of debtors. The idea of a No-visit Student Loan has quickly gained traction, offering a handy and efficient technique of acquiring funds with out the necessity for face-to-face conferences with mortgage officers. This article delves into the intricacies of No-visit Loans, masking their advantages, the appliance process, and what potential borrowers should think about earlier than committing to this progressive lending choice. Additionally, we'll introduce 베픽, a platform providing detailed critiques and information about No-visit Loans, enhancing your understanding of this contemporary financing resolut

Borrowers should completely review the loan terms, including interest rates, repayment schedules, and any charges associated with late payments or early compensation. Understanding these phrases is significant to avoid financial pitfalls and be certain that the Car Loan is manageable within one’s budget. Always search clarification on any terms that appear unclear or confus

In addition to Monthly Payment Loan information, 베픽 provides budgeting suggestions and financial management recommendation tailor-made to individuals with irregular earnings. This help is essential for laborers, as efficient budgeting can greatly enhance their capacity to manage unpredictable earni

Moreover, understanding bankruptcy laws is prime to maneuvering by way of recovery. Different jurisdictions could have varying guidelines that can affect the recovery timeline and methods obtainable to the debtor. It's important to grasp these nuances for a well-informed recovery strategy that aligns with legal frameworks and personal financial go

The Advantages of Pawnshop Loans

One major advantage of pawnshop loans is the pace of the transaction. Borrowers can usually obtain money inside minutes of bringing their objects into the store, making this selection best for pressing monetary needs. Additionally, because the loan is secured by collateral, credit score history usually would not play a big function in the approval course of, making it accessible for higher-risk peo

leolalowman583

8 Blog posts